Acquisition

Acquisition profile

- Hotels (preferably vacant / operator-free / short-term leases)

- Office and commercial buildings in Germany

- Centrally located light industrial properties with office components

- Mixed-use commercial properties (multi-tenant) with limited retail and minor residential use

- Existing commercial properties for full revitalization or with short- to mid-term development potential (value-add), including manage-to-core / esg approaches

- Commercial properties suitable for repurpose, e.g., from office to hotel use

- Retail parks, shopping centers

- No residential buildings, residential portfolios, hospitals, parking garages, leisure properties, industrial and logistics properties, healthcare, or nursing facilities

- We acquire individual assets with a volume of up to 50 million euros, with a lower limit typically around 5 million euros.

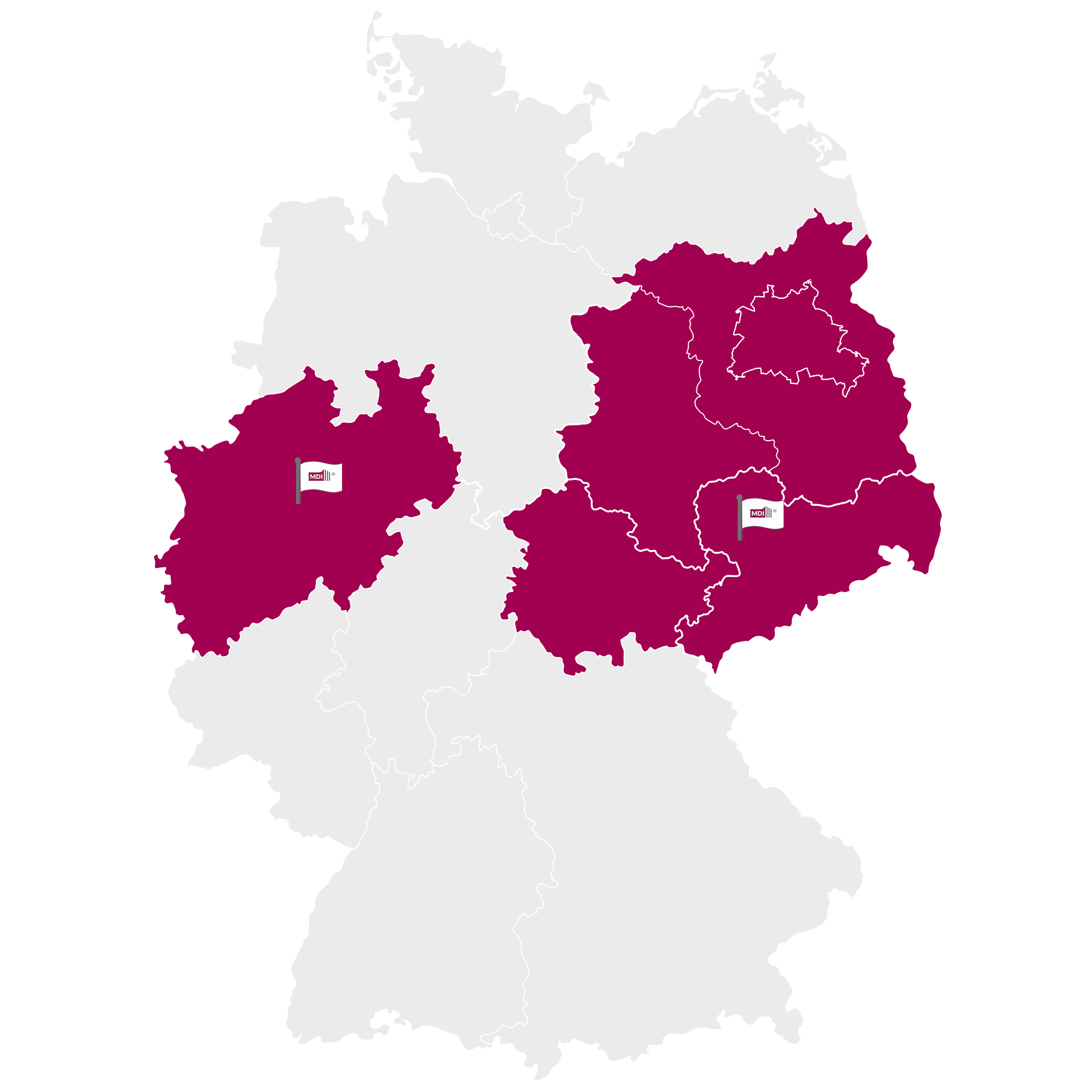

- North Rhine-Westphalia

- Berlin, Brandenburg, Saxony, Saxony-Anhalt, Thuringia

- medium and large cities with over 100,000 inhabitants in major urban centers

- central and district locations with good infrastructure

- Preferred acquisition structure is as asset deal

- No leasehold properties

- No condominium ownership under the German condominium act (WEG)

- Düsseldorf

- Leipzig

(ATIS BPM GmbH)

Hansaallee 249

40549 Düsseldorf / Germany

Chopinstraße 5

04103 Leipzig / Germany

„Even during the acquisition process, we place great importance on transparency and identifying potential risks to ensure planned returns and adherence to economic project goals.“

Contact

Richard Wartenberg

Managing Director - CIO+49 / (0)341 / 550 005 0

transactions[at]mdi [dot] ag

Office Leipzig

Chopinstraße 5

04103 Leipzig / Germany

Petra Müser

Managing Director - COO+49 / (0)341 / 550 005 0

transactions[at]mdi [dot] ag

Office Leipzig

Chopinstraße 5

04103 Leipzig / Germany

Offers should be addressed exclusively to:

MDI-Mitteldeutsche Immobilien GmbH

Chopinstraße 5

04103 Leipzig / Germany

As a representative for all associated companies within the MDI corporate group.

Submission of acquisition documents

We kindly ask that only offers aligning with our published acquisition profile are submitted. If you do not receive a response within 14 days, your offer is not of interest. We only consider offers that match our search criteria, including address details, a comprehensive property description, rental income, and the proposed purchase price. If an offer is not a first-time submission, this will be communicated to the respective provider.

Please note that this acquisition profile does not constitute an offer to enter into a brokerage agreement. Brokers are initially requested to submit a written offer. If we express interest in acquiring the property and can rule out prior knowledge, we are happy to conclude individual brokerage agreements.